How to donate to Notre-Dame Cathedral:

Thank you for visiting this page! We laid out a simple guide on how to donate to Notre-Dame Cathedral.

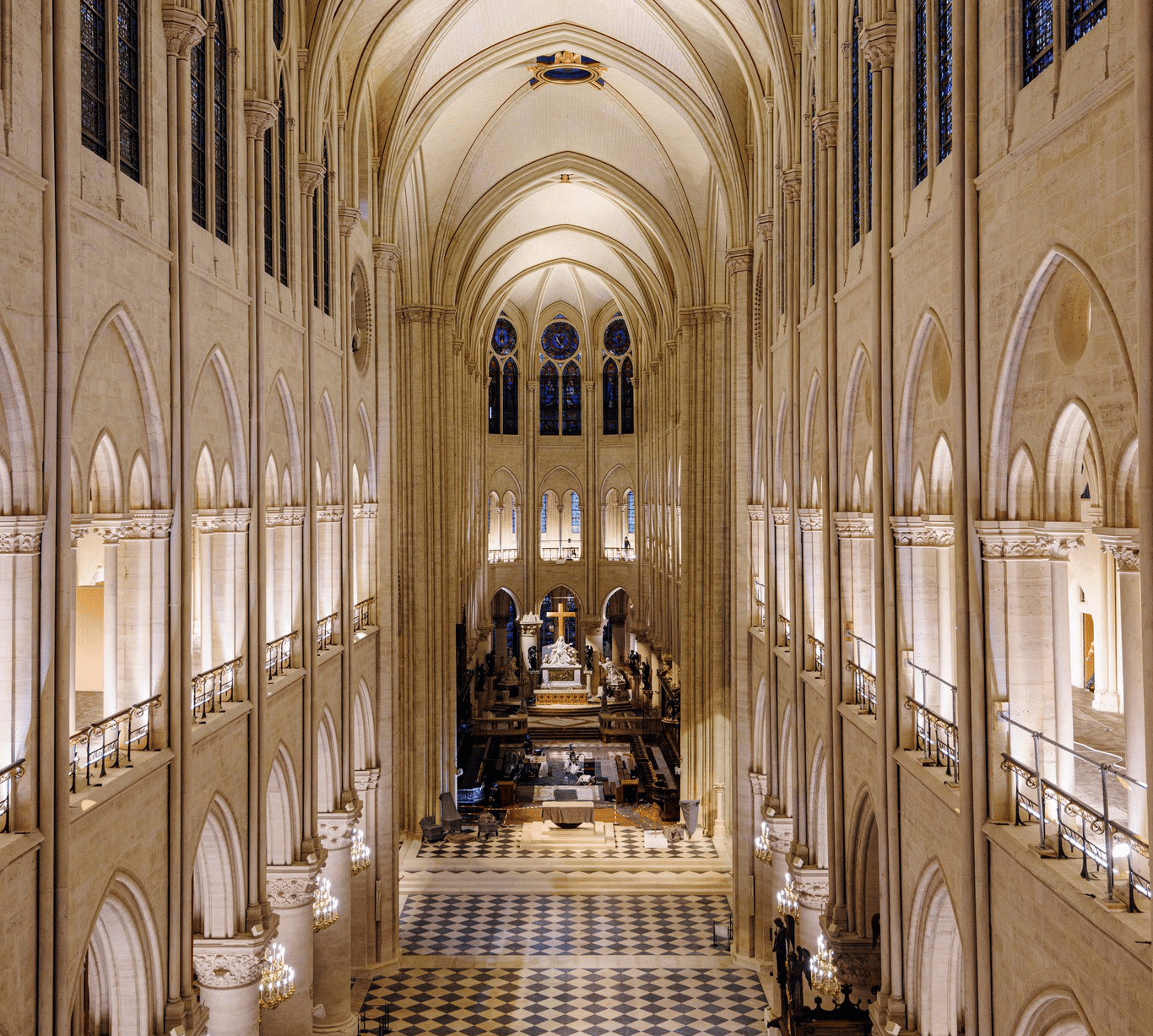

Friends of Notre-Dame de Paris was established in 2017 and began to support efforts to restore Notre-Dame Cathedral. Pollution, rain and time weakened the cathedral’s basic structure, and an ambitious $135 million campaign was planned to save Notre-Dame de Paris.

On April 15, 2019, the scope of that campaign dramatically changed when a fire broke out under the eaves of the cathedral’s roof. The fire that devastated Notre-Dame de Paris, shocked the world and left us all feeling helpless.

However, there are many ways that we can each do our part to help restore this iconic landmark to its former glory.

In this blog post, we will explore 9 practical ways that you can donate to Notre-Dame de Paris and play a role in its restoration. Whether you’re looking to make a monetary donation or simply spread awareness, there are many ways that you can help right now. So, if you’re ready to make a difference, keep reading to discover how you can support Notre-Dame de Paris and ensure that this beloved cathedral continues to stand for generations to come.

Donate To Notre-Dame Cathedral By Check

As a friend of Notre-Dame de Paris, you have the option to support the Cathedral’s reconstruction offline by making a check.Please make checks payable to Friends of Notre-Dame de Paris and mail to:

PO Box 505

Etna, NH 03750-0505

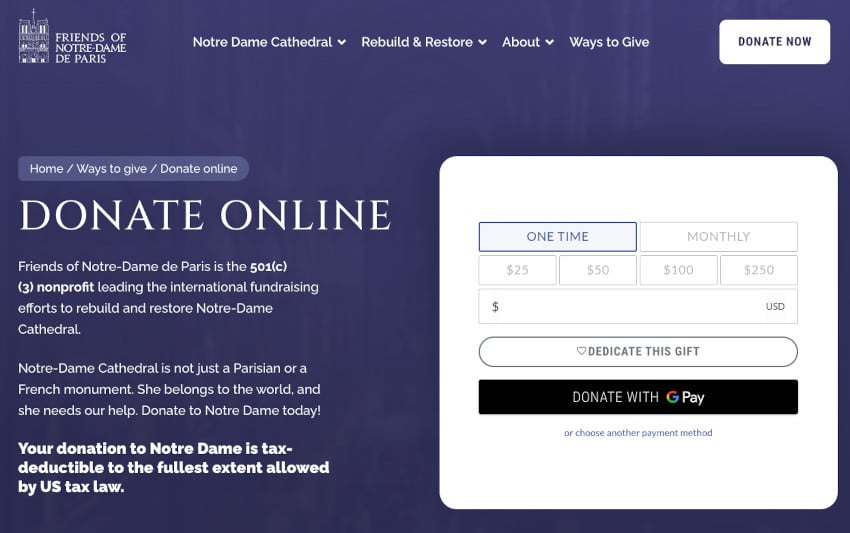

Donate to Notre-Dame de Paris online

Friends of Notre-Dame de Paris is the official public charity leading the international fundraising efforts to rebuild and restore Notre-Dame Cathedral. Your online donation is tax-deductible to the fullest extent allowed by US tax law. You can choose to display your donation to the public or make the donation anonymously. You can also decide to cover payment processing fees (Stripe) so 100% of your donation goes to rebuilding Notre-Dame Cathedral. Donate online to Notre-Dame Cathedral

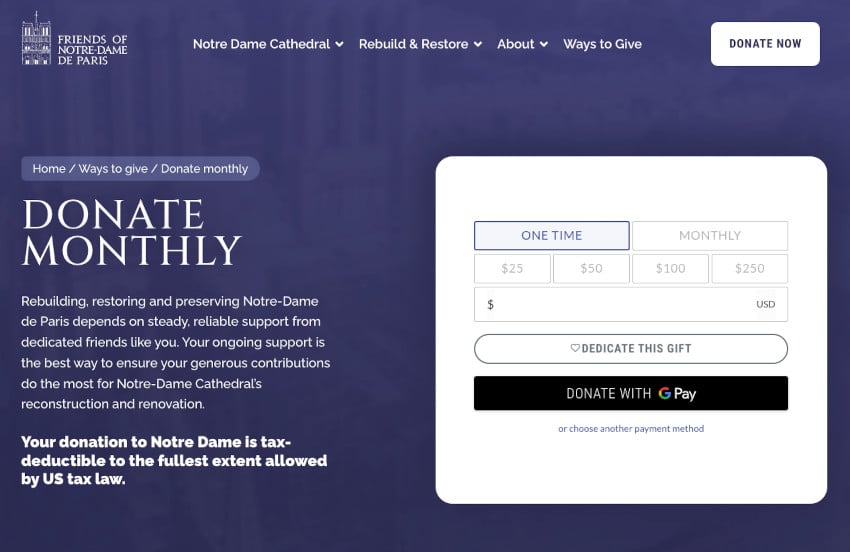

Give monthly to Notre-Dame Cathedral

What is the benefit of giving monthly?

Rebuilding, restoring and preserving Notre-Dame de Paris depends on steady, reliable support from dedicated friends like you. Your ongoing support is the best way to ensure your generous contributions do the most for Notre-Dame Cathedral’s reconstruction and renovation.

Giving monthly is the most efficient way to give:

- It is simple – your gift is processed automatically each month, saving you time and effort.

- It is flexible – you are in control and can make changes to your ongoing pledge at any time.

- It is effective – recurring gifts are more efficient, so more of your support goes to rebuilding and restoring Notre-Dame Cathedral.

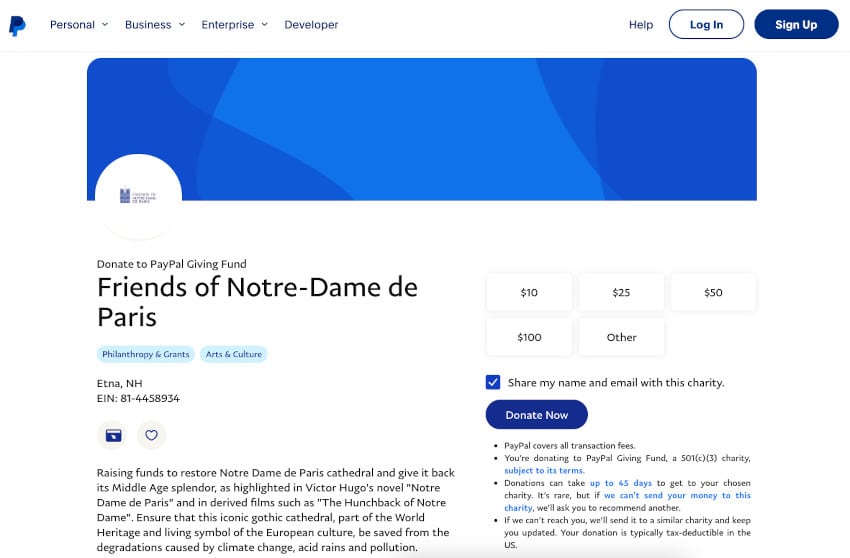

Donate to Notre-Dame de Paris through PayPal

Friends of Notre-Dame de Paris gives you the opportunity to rebuild Notre-Dame Cathedral by donating through our partner PayPal Giving Fund. PayPal covers all transaction costs for donations made on this site, ensuring that 100% of each gift made is available to charity. Your donation will be made to PayPal Giving Fund, an IRS-registered 501(c)(3) public charity (Federal Tax ID: 45-0931286). PayPal Giving Fund will provide the receipt for your donation, which is subject to its donor terms of service. PayPal Giving Fund verifies that receiving charities have tax-exempt status with the IRS and are not on recognized economic sanctions lists. Charities enrolled with PayPal Giving Fund will typically receive funds in their PayPal accounts within 15 to 45 days after PayPal Giving Fund’s receipt of a donation.

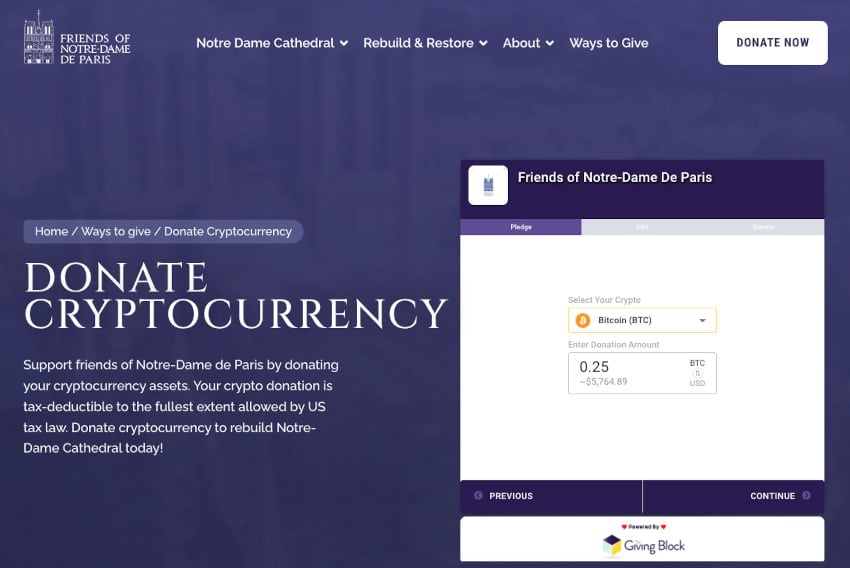

[NEW] Donate cryptocurrency to help rebuild Notre-Dame de Paris!

Friends of Notre-Dame de Paris gives you the opportunity to rebuild Notre-Dame Cathedral by donating Bitcoin, Ethereum, Litecoin and other cryptos!

Why Donate Crypto to Notre-Dame? Taxes!

There’s a reason high net worth individuals tend to donate property instead of cash. Donating cryptocurrency directly to a 501c3 nonprofit is more tax efficient and can save you money.

The IRS classifies cryptocurrency as property for tax purposes which means it is typically the most tax efficient way to support Notre-Dame Cathedral. When donating crypto, You receive a tax deduction for the fair market value of the crypto, and you avoid the capital gains tax you would have incurred if you had sold the crypto and then made a donation. That means you’re able to donate more, as well as deduct more on your tax return. The difference? Sometimes more than 30%.

How to donate Bitcoin or other crypto assets to Notre-Dame?

If you provide an email, you will automatically receive a tax receipt after donating here: Donate Bitcoin or Ethereum to Notre-Dame de Paris today!

Donate to Notre-Dame Cathedral by wire transfer

As a friend of Notre-Dame, you have the option to support the Cathedral’s reconstruction offline by making a wire transfer. Please contact friends@notredamedeparis.fr for more information.

Donate appreciated securities to Friends of Notre-Dame de Paris

Donating publicly traded stocks, bonds or mutual funds to Friends of Notre-Dame de Paris is a simple and smart way to help rebuild, restore and preserve Notre-Dame Cathedral.

When you donate appreciated securities, you are able to deduct the gift as a charitable donation and avoid capital gains tax at transfer. This allows you to leverage a larger donation by using appreciated securities rather than cash to make your gift.

Please contact Michel Picaud (michel.picaud@notredamedeparis.fr) to initiate your gift of stock.

How do I make a gift of appreciated securities (publicly traded stocks, bonds and mutual fund shares)?

You transfer appreciated securities to Friends of Notre-Dame de Paris, and then Friends of Notre-Dame de Paris sells the securities and uses the proceeds to fund critical renovation and restoration works.

How do I benefit by making a donation of appreciated securities?

You benefit in several ways, such as:

- You receive credit and an immediate income tax deduction for the fair market value (average high and low prices on the day of the transfer).

- You avoid capital gains tax.

Please note that the securities you use to make your gift must have been held by you for more than one year to be fully deductible.

Consider leaving your legacy: Bequests and Planned Giving

When you leave a gift to Friends of Notre-Dame de Paris in your will or estate plans, you ensure that Notre-Dame Cathedral will be preserved for future generations to discover and find joy in this special place.Consider leaving behind a lasting legacy by including Friends of Notre-Dame de Paris in your estate plans. Please contact Michel Picaud at michel.picaud@notredamedeparis.fr for more information.

What is the benefit of making a bequest?

Bequests and planned gifts offer you multiple benefits, including:

- Your gift costs you nothing now, and you retain control of your assets during your lifetime.

- You can change your mind or modify your gift if circumstances change.

- Your gift may provide tax savings or help reduce the tax burden for your heirs.

- Your gift can remain anonymous if you choose.

- You can leave a gift in honor or memory of someone who inspired your love of Notre-Dame Cathedral and Paris.

- You will be remembered as someone whose legacy included promoting our shared cultural heritage, as Notre-Dame Cathedral is not only a French landmark, but a global monument.

How does planned giving work?

- You designate a particular asset or a percentage of your estate to Friends of Notre-Dame de Paris by including a bequest provision in your will or revocable trust. You can do this while creating your will or trust, or by amending an existing one with a simple document.

- You inform Friends of Notre-Dame de Paris of your commitment by contacting Michel Picaud (michel.picaud@notredamedeparis.fr), which helps for planning and ensures your wishes can be fulfilled.

- Friends of Notre-Dame de Paris received the gift after your lifetime and applies it to the objective you specified, with unrestricted charitable gifts used to rebuild, restore and preserve Notre-Dame Cathedral.

Is my planned gift tax-deductible?

Your distribution is fully deductible for federal estate tax purposes, and there is no limit on the deduction your estate can claim. Additionally, the gift is usually exempt from state inheritance taxes.

How to donate to Notre-Dame Cathedral from your DAF?

Recommend grants to Friends of Notre-Dame de Paris directly from your donor-advised fund

If you don’t see your account listed in DAF Direct, contact your DAF sponsoring organization or contact us here.

What is a Donor-Advised Fund?

A donor-advised fund (DAF) is a centralized charitable account. It allows charitably inclined individuals, families and businesses to make tax-deductible charitable donations of cash, publicly-traded stock and in some case, certain illiquid assets, to a public charity that sponsors a DAF program.

What if my DAF sponsoring organization isn’t listed in DAF Direct?

If your sponsoring organization isn’t an option listed in DAF Direct, contact your sponsoring organization directly to make a grant recommendation. You will need to give them our full name (Friends of Notre-Dame de Paris), tax ID number (81-4458934) and address (1717 Pennsylvania Ave NW, Suite 425, Washington, DC 20006).

What are the advantages of giving through a DAF?

- Simplicity: Your sponsoring organization handles all record-keeping, disbursements (including an option for automatic distributions), and tax receipts and provides you with a single document at tax time.

- Timing: You can request that a donation be made at any time or make automatic recurring gifts on a schedule of your choice.

- Open to all: Individuals, families, companies, foundations and other entities can start a DAF.

- Increase your philanthropic capital: With varying investment strategies available, the funds in your DAF have the potential to grow tax-free.

- Flexible funding options: Fund your DAF with the assets of your choice, including cash, stock, securities, and even real estate.

- Join the Friends of Notre-Dame de Paris community, and take part in this historic moment to rebuild Notre-Dame Cathedral.

What is your tax ID number?

If you are looking to make a grant recommendation through your DAF, Friends of Notre-Dame de Paris’ tax ID number is 81-4458934.

How to donate to Notre-Dame Cathedral when you live in Canada?

Friends in Canada can make tax-deductible donations through the Notre-Dame de Paris Canada fund.

How to donate to Notre-Dame Cathedral when you live in Canada

For Canadian donations by cheque: Make the cheque payable to the KBF CANADA Foundation, mentioning ‘Project E206: Notre-Dame de Paris Canada’ in the section ‘For’, and post it to: KBF CANADA Foundation, 1 Place Ville Marie, Suite 1670, MONTREAL, QC, H3B 2B6 – CANADA.

For direct deposits: Send an email to the KBF Foundation CANADA at info@kbfcanada.ca or call +1 514.481.2000

All donations are eligible for a tax receipt in Canada.